- October 8, 2024

- Posted by: lunar1

- Category: cash advance d?finition

twenty two October Absolutely the Guide to Automotive loans having Veterans

The acquisition regarding a different sort of car are enjoyable and you may exciting, regardless if you are purchasing one for your self or individuals you love. But, the whole process of providing accepted for automobile financing for veterans is also be difficult. Don’t get worried, regardless if. There are numerous choices for obtaining an auto loan even in the event you’ve got bad credit or no borrowing from the bank.

In this article, you will see everything you need to find out about to get an auto once the an experienced, including the type of automobile financing, where you might get you to definitely, what you need to become approved, and you can what type of auto buying. Why don’t we diving inside!

Do you require an effective Va Mortgage to have a motor vehicle?

The fresh U.S. Agencies off Experts Issues (VA) cannot really promote automotive loans. not, from auto allocation and you may adaptive gizmos work with, the new Va can assist veterans and you can effective responsibility military that have to acquire a car or truck.

Where you’ll get a car loan to have Experts

As stated above, you can’t score a car loan actually from the Va for example you can with Virtual assistant mortgage brokers. When the, although not, you are unable to drive on account of an impairment suffered if you find yourself for the active obligations, you may qualify for an automible work for.

This will be known as the auto allowance and you will transformative products work for in the usa, that gives a one-big date percentage all the way to $21,488 so you’re able to experts with being qualified injuries.

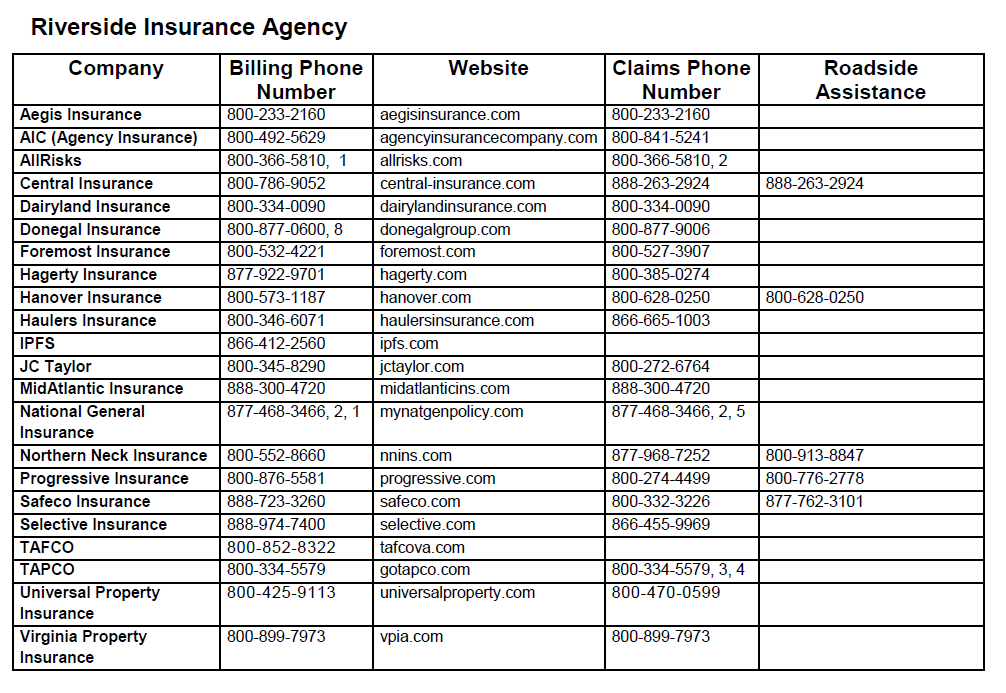

Since you can not get an auto loan regarding Va, there is compiled a summary of options lower than for where you can initiate your pursuit.

Agent Financial support

Transitioning of energetic obligations to help you civil lifetime is difficult. A different existence is not necessarily the only difficulty, because you can in addition to deal with this new financial difficulties.

When you are a veteran and you may think about to find a vehicle or you would like special devices, you really have solutions. These could tend to be obtaining Va guidance, contrasting military-specific cost out-of vehicle suppliers, and you will protecting capital out of credit unions devoted to offering armed forces team.

Fundamentally, traders bring your credit score into consideration whenever deciding if you meet the criteria for a loan or not. If you find yourself having difficulty taking financing, you might have to improve your borrowing from the bank wellness first.

Borrowing Unions Auto loans With Discounts otherwise Special Rates to have Pros

Overall, borrowing from the bank connection automobile financing to own pros could be less expensive having you if the an excellent Virtual assistant work for is not available somewhere else. As opposed to making a profit, credit unions focus on helping their players.

A card connection can get save some costs for individuals who meet with the requirements. Antique loan providers may not have the best choices for army team, therefore consult a card union one to provides her or him particularly.

PenFed Borrowing from the bank Commitment

PennFed, or even the Pentagon Federal Borrowing from the bank Relationship, provides armed forces staff and specific civilian connectivity. As you need create a primary put out-of $5 towards a family savings to participate, PenFed you will definitely present glamorous mortgage terms and conditions using their auto-to invest in solution.

Navy Government Credit Connection

While you are in the Armed forces, Marine Corps, Navy, Air Force, Coast-guard, Sky National Protect, or resigned armed forces, you may want to think Navy Federal Borrowing from the bank Union to suit your car finance. NFCU registration is additionally available to particular civilians, instance government staff.

It offers finance for brand new and you can used autos, motorbikes, and other vehicle, however it does not give funds having put vehicles purchased regarding private manufacturers or rent buyouts.

Since the a person in NFCU, you may also qualify for aggressive automobile financing while inside the the market having an alternative otherwise used car. It’s also possible to qualify for an additional 0.25% interest write off if you undertake direct deposit for your month-to-month repayments.