- December 13, 2024

- Posted by: lunar1

- Category: instant payday loans direct lenders no credit check

Normally a loan feel refuted just after closing? If you are searching to get a home during the Ocala, Fl, and intend on having fun with a lender, you will be thinking if for example the loan will be rejected once you finalized on your own new house.

This is usually rare for a financial loan is refused at this an element of the to find techniques, but it’s commercially possible. In this post, our team yourself Sold Guaranteed Realty – Coldwell A home Qualities will speak about four circumstances that will possibly end up in financing denial article-closure.

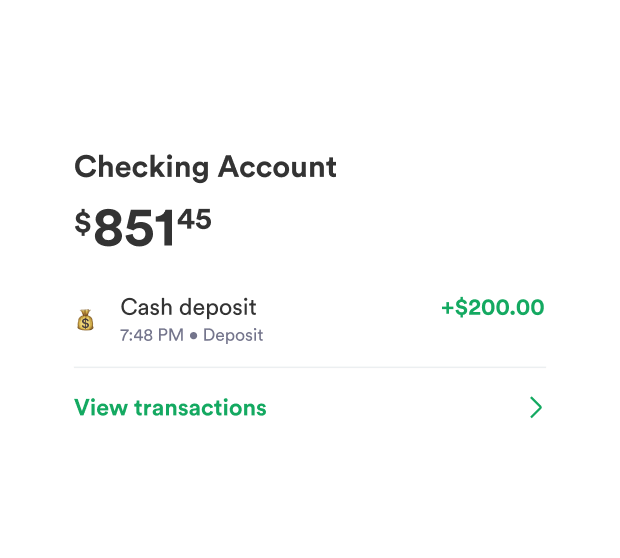

Extreme Improvement in Your bank account

Whether your financial predicament alter instantly, including, a serious loss of income otherwise a great number of the obligations, in that case your mortgage will be rejected. Always, lenders create a last credit assessment prior to technically financing the latest loan. If they come across one radical alter, they might just take all of them since the cues that you will never find a way to properly pay their financial. This could make sure they are eventually refuse the mortgage number, especially if such financial change affect the regards to the borrowed funds agreement your signed. Therefore, its essentially informed to get rid of taking https://paydayloancolorado.net/pagosa-springs/ out fully a new distinctive line of borrowing otherwise applying for almost every other large money whenever you are buying your the newest domestic.

Violating the mortgage Words

Following the underwriting procedure is gone and your loan might have been recognized, possible sign an ending revelation one outlines the past terms and conditions and requirements of home loan. Such criteria range between financial so you can lender however, constantly tend to be financial standards and requirements with the standing of the property. While most on the info is verified in underwriting procedure, the financial institution will over a final evaluate just before issuing the newest financing. If you cannot see such conditions till the financing shuts, the lending company may reduce brand new resource until the conditions try fulfilled otherwise refute they altogether.

High Issues with the house or property

In some cases, items related to the state of the home may cause a loan denial after closing. Including, in the event the possessions assessment comes in significantly below the purchase rate, it could change the financing-to-really worth proportion and the lender’s readiness to cover the loan. Similarly, in the event the possessions possess undisclosed faults or doesn’t fulfill certain financial requirements, it could bring about financing assertion or reduce inside the resource.

Con

Lenders simply take con and misrepresentation most positively that can revoke mortgage recognition once they discover proof dishonesty or inaccuracies on the loan application otherwise help files. Delivering untrue facts about your income, a job, possessions, or expense could cause that face loan assertion shortly after closing, once the lenders have the directly to rescind the mortgage at any date when the swindle try identified.

Judge or Regulatory Factors

Alterations in judge otherwise regulating criteria may also affect the mortgage approval process and you will probably bring about financing assertion after closure. Such as, if the brand new rules try observed that affect the fresh borrower’s qualification to have the mortgage or perhaps the lender’s power to fund it.

Eventually, closure to your a property along with signing a closing disclosure along with your financial dont guarantee your loan was funded. To get rid of the risk of financing denial once closing, its important to share and start to become hands-on with your financial during the entire purchasing processes.

Avoiding financing denial begins with searching for a leading financial so you can focus on. Yourself Offered Protected Realty – Coldwell A residential property Qualities, Scott Coldwell and all of us has actually intimate relationship using ideal loan providers during the Ocala and you will Northern Central Fl. We are able to use our very own connections to send that a loan provider exactly who suits you and financial situation.

Our company is the top agent in the Ocala for a conclusion. Except that our very own world connections, i provide unique buyer pledges which make the newest to find processes risk-free. Including our Purchase it Right back Ensure, gives you the solution to return your house about experience you are disappointed inside unconditionally.

For additional information on working with Your house Marketed Guaranteed Realty – Coldwell A house Properties to order a house in Ocala or the encircling elements, phone call 352-290-3512, or fill in the design in this article.