- October 14, 2024

- Posted by: lunar1

- Category: cash advance of america

That have FHA money the borrowed funds insurance policies percentage is high as well as the lowest down-payment is 3.5% However the FHA mortgage typically has a lower life expectancy rate of interest.

Financial insurance policies to the a keen FHA can not be got rid of. To your a conventional loan PMI is taken away after you strike 78% financing so you’re able to vlaue.

New advance payment count will then be deducted about price of the home, in addition to remainder is the number of loan otherwise mortgage which is requisite.

The latest advance payment varies depending upon the kind of home and your own to order state. It will also are very different dependant on your credit score and obligations-to-income ratio.

To possess a traditional mortgage, a minimum down payment necessary try 3% and therefore family should be a primary residence and you also need to become an initial-big date home buyer. The purchase price need to be at the $647,two hundred (conforming mortgage restriction) otherwise shorter so you can qualify for good step 3% deposit.

Right after which when your home is perhaps not one-house, otherwise provides multiple unit, you will need certainly to set fifteen% off.. If you are looking to order a home a lot more than $647,200, you will want a top harmony loan.

Jumbo Money

A jumbo financing are a home loan that is larger than $726,two hundred . Jumbos can be found in each other fixed-speed and you can variable-rates types, and they are often used to purchase almost any possessions.

Jumbo funds can be used for a variety of motives, and additionally to acquire a home, refinancing your financial, otherwise combining personal debt. When you are searching for a giant amount borrowed and should not glance at the difficulty of going a personal mortgage, next an excellent jumbo loan is generally right for you!

Everything about PMI (Personal mortgage insurance rates)

People advance payment below 20% including need PMI, called private mortgage insurance coverage. That it PMI needs due to the fact financing is regarded as a bigger risk into the financial. PMI can cost ranging from .5% or step 1% of the mortgage that is constantly rolled into month-to-month home loan commission.

After you have repaid an adequate amount of the borrowed funds dominating, the new PMI is going to be dropped. Which generally is when the primary mortgage equilibrium is 80% of one’s residence’s new value, which means that you have 20% equity of your house. When this occurs you could potentially request the lender get rid of PMI about loan. It might immediately come off should your mortgage harmony is 78% of the home’s brand-new worthy of, otherwise you’ve attained twenty two% security of your property.

Kind of traditional money

Conforming funds need to meet assistance set by the Federal national mortgage association and you will Freddie Mac computer. Advice include credit score, downpayment count, income criteria, and you will financing restrictions.

A low-conforming old-fashioned loan has no one loan limits. Additionally it is labeled as an effective jumbo mortgage. These mortgage is backed by a personal individual otherwise financial institutions instead.

Fixed-rates old-fashioned money enjoys the rate a similar it does not matter how much time you have your own home loan that can setting their mortgage percentage will remain a comparable.

Such funds is going to be around 3 decades a lot of time, therefore the interest rate is actually locked set for the whole 30 years of the mortgage bad credit loans Augusta IA.

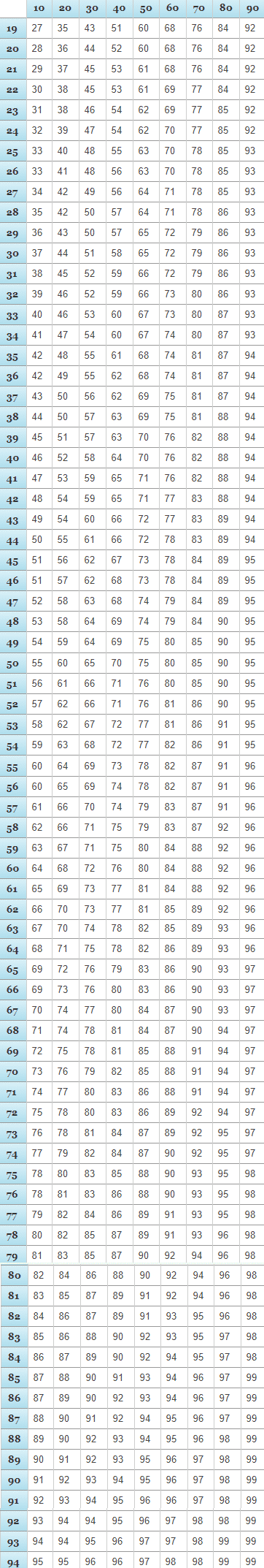

Fixed-rate fund may be acquired to possess ten, 15, 20, otherwise 3 decades. The fresh new smaller term of your financing, the low the speed will likely become. Although not, a smaller identity will mirror a higher payment than simply good 31 12 months mortgage.

An alternative choice is actually an adjustable-rate home loan, in which particular case the pace fluctuates throughout the years. These types of Possession usually have a predetermined rate into earliest 5 so you can a decade. The interest rate commonly increase or fall and additionally government interest rates following predetermined time of about three, four, 7 or a decade.