- November 14, 2024

- Posted by: lunar1

- Category: where get cash advance

Toward current financial and you will property drama that every Canadians is experiencing, to shop for a house has started to become a lot more about costly. In lieu of strengthening stick-created home, most people are embracing are produced homes. The majority are plus strengthening cellular house.

What we is generally confused about although not is whether otherwise maybe not a cellular otherwise manufactured family shall be funded.

A lot of people believe that as they aren’t constantly long lasting belongings for every se, it is not possible to invest in them, however, this isn’t true.

This type of are formulated land can still costs a great amount of money, and thus for many people getting a home loan otherwise financial support ‘s the only option. Let’s talk about everything you need to realize about bringing a good mortgage to have a made home.

Positives and https://paydayloanalabama.com/weogufka/ negatives of getting a created Home

Naturally, buying a created family can nevertheless be seemingly costly. You can spend multiple $100,000 into such as for instance a created domestic if not with the a mobile family.

Hence, early contemplating to invest in a produced home, simply take a glance at the are produced house benefits and you can cons.

Yes, you’ll find one another advantages and disadvantages to modular home, plus they are all the very important for you to consider before you can see investment you to.

- Believe that a modular family will set you back ranging from $80 and you can $160 per sq ft, while a consistent family could cost $275 per square foot, or higher, especially if you come into an expensive urban area.

- When you find yourself strengthening a standard or are available family, especially if it is with the a permanent foundation, you could nonetheless with ease move they, than the a traditional family that will most likely only need is demolished.

- Should it be a modular family otherwise a cellular family, the are made homes are manufactured for the a controlled ecosystem which is not met with sun and rain. Its hence better to make are built homes to full cover up requirements and you will in order to maintain consistency.

- A separate big bonus would be the fact are built property usually do not depreciate from inside the worthy of right away, if at all.

- You to definitely disadvantage to to shop for a made home is that they’re constantly placed on rented otherwise hired residential property, which for this reason ensures that the home doesn’t really get into you.

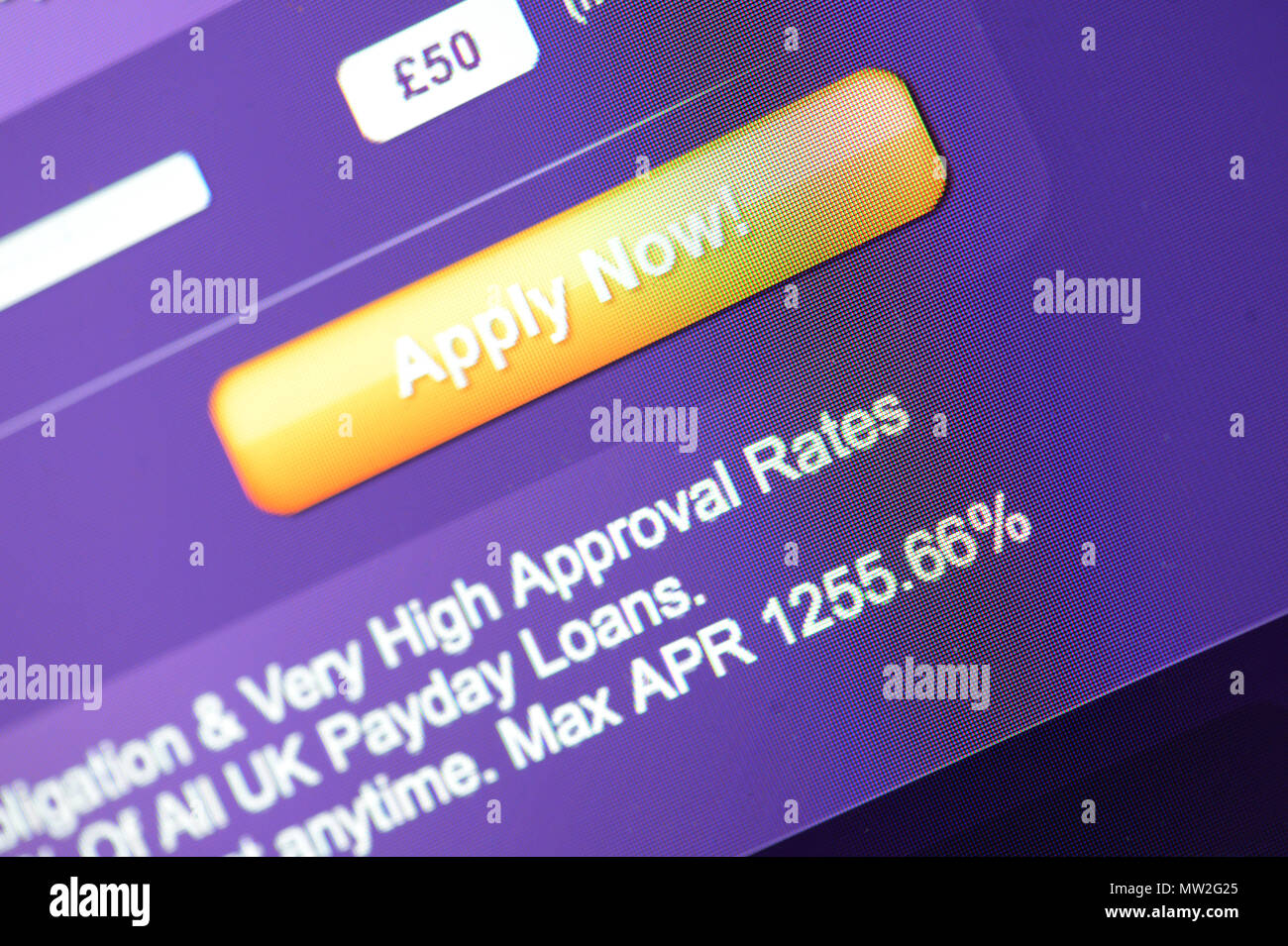

- Because you have a tendency to cannot very own the latest belongings, capital a cellular or are manufactured home can be more expensive than just resource a consistent household. This is why, lenders often costs greater interest levels.

- It can hence be difficult locate a lender that money their mobile or modular house. Of a lot financial institutions won’t finance such.

Can All types of Were created Land End up being Mortgaged

Bringing home financing to have a created domestic sometimes can be be difficult, particularly if you cannot own the new belongings the home is to your.

Thus, in some cases, it may be difficult to find a mortgage for a cellular home that’s not oneself permanent possessions, though it is still usually you can to acquire financing.

Standard House

Earliest, we have the modular household, which is the sort of domestic that is produced in areas for the a manufacturer otherwise strengthening center. This type of personal sections is upcoming brought to the final strengthening site and you will constructed and you may put together towards a permanent foundation.

When they is actually secured set up and you can 100% built, the fresh new designers complete the outside. What’s interesting is that with a good standard household, in case it is well constructed, you actually can’t tell that it’s a modular form of, as opposed to one which was built from the ground upwards. You truly must not have issues providing a modular mortgage loan.