- October 4, 2024

- Posted by: lunar1

- Category: how does payday loan

Fundamental deduction versus. itemizing

You may have a choice every year on whether or not to make standard deduction on the Irs processing otherwise itemize each of your deductions. Demonstrably, you can easily find the the one that minimises your goverment tax bill way more. However, you may want to propose to duck the effort out of itemizing if for example the benefit you score away from doing so are minimal.

- Maried people filing as one: $25,900

- Solitary taxpayers and you may partnered individuals submitting separately: $12,950

- Minds away from properties: $19,400

Renovations

You can deduct the interest on the HEL otherwise HELOC costs merely with the proportion of this borrowing from the bank which had been used to get, make or drastically improve your house you to obtains the borrowed funds. Thus, if you put a few of the proceeds to other one thing, you simply can’t deduct the interest to the those items. They may include debt consolidation reduction, medical costs, a cruise, a wedding, or any other using one wasn’t having renovations.

Just what constitutes costs you to drastically alter your house? Unfortunately, there is no obvious definition. But many suggest this means developments that add convenient worthy of so you’re able to the house or property.

Thus, repairs, remodelings and additions will in all probability meet the requirements projects you to alter your household. However, consult with your taxation elite group before you can accept functions one to might not include reasonable really worth to your home. Which may become starting an enormous tank otherwise good 20-vehicles underground garage. Talking about points that of several coming consumers you are going to worth less than you do or even esteem because an accountability.

Restrictions to household security mortgage tax deduction amounts

If you’ve used your house because collateral to possess high borrowing from the bank, you do not have the ability to subtract the attention on your whole debt. To put it differently, you’ll find limits towards allowable components of such financial and you can home security funds or lines of credit. New Internal revenue service shows you:

You could potentially subtract mortgage appeal towards first $750,000 ($375,000 if hitched submitting individually) regarding indebtedness. However, higher limitations ($1 million ($five-hundred,000 if the partnered submitting separately)) apply while you are subtracting home loan attention away from indebtedness sustained in advance of .

Very, if the earliest and second mortgage(s) enjoys balances more than $750,000, you can deduct focus towards the precisely the very first $750,000 of those. You to definitely takes on you will be married and you can processing jointly as well as your financing are dated immediately after .

How exactly to subtract family collateral loan notice

From year to year, you need to receive a type 1098 regarding business otherwise organizations to which you will be making payments on the earliest and you can second financial(s). That it lies aside one to year’s home loan repayments. And it vacations them into focus and you can dominating receipts. You can subtract just the https://elitecashadvance.com/installment-loans-mi/charlotte/ attention costs.

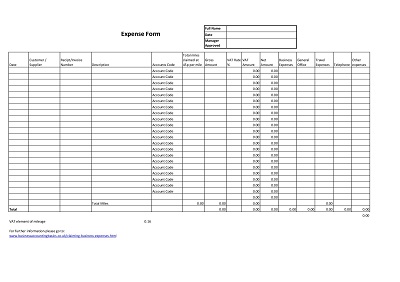

Your go into the amounts you’re subtracting, because revealed in your 1098 variations, to your Agenda Part of the design 1040 income tax return.

Will it be worth playing with a house equity loan in the event it isn’t tax deductible?

In some instances, household collateral financing and you will HELOCs are usually the least pricey forms of borrowing from the bank available.

Think of the income tax deduction given that cherry towards pie. It might create a small on beauty of brand new cake (or loan). But it’s most likely not just what made you desire they on the beginning.

Should i get a property collateral loan otherwise an excellent HELOC?

If you find yourself a citizen and require so you can acquire a serious share, a great HEL otherwise HELOC will be the right choice. However, you favor relies on your needs and you can preferences.

HELs is easy fees fund that have fixed interest rates. You may make one fit your budget by the choosing a term (enough time the loan continues), and that means you possibly enjoys a lot of reduced money or a lot fewer big of those. Once the you’ll be investing closing costs whatever the count you obtain, it could be beneficial to attract more substantial contribution.

HELOCs be a little more complicated and you’ll read up on all of them before you choose that. They operate a while for example handmade cards because the you might be considering a credit limit and certainly will use, pay and you can borrow once more around that maximum whenever you want. While spend monthly attention merely on your latest harmony. They tend for shorter – possibly zero – settlement costs than simply HELs however, include adjustable interest levels.

Second strategies

Like with really forms of borrowing, there are a variety of interest rates, loan charge, and will cost you available to you. So, its important that you check around to suit your very best package. You might rescue several thousand dollars.

Let us help you with you to definitely. We are able to expose you to loan providers that can give you aggressive dealspare their prices (while others) and pick their the very least high priced alternative.